Covalence provides investors and asset managers with ESG ratings, greenwashing risk indicators, SDG scores, ESG news data, and investment solutions. We’re also involved in executive education for finance professionals.

Our monthly-updated ESG ratings cover 15000 listed companies globally.

Our monthly-updated ESG ratings cover 15000 listed companies globally.

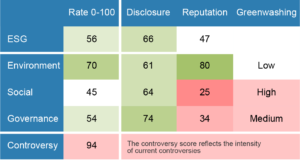

They are based on data publicly reported by companies (disclosure) and on news sentiment reflecting the perceptions of stakeholders such as the media and NGOs (reputation), both positive (endorsements) and negative (controversies).

Our ESG ratings can be used for risk management, factor investing, positive and negative screening, ESG integration, and thematic investments.

Institutional investors and asset managers are facing increasing demands for exclusions of certain companies due to behaviour deemed not to be in line with international standards.

Institutional investors and asset managers are facing increasing demands for exclusions of certain companies due to behaviour deemed not to be in line with international standards.

With the Norms-based exclusions monitor, Covalence wants to help professional investors better manage such requests.

This tool covers 60 exclusion lists published as part of their responsible investment policies by asset owners and asset managers, as well as by the United Nations. All norms-based (or conduct-based) exclusions are monitored on a quarterly basis.

It includes: > 1,000 companies listed; quarterly updates; regular monitoring and addition of new lists; transparent documentation of sources.

This tool is useful in several ways:

- Decision support

- Regulatory compliance

- Benchmarking

- Risk management

- Reputation management

This tool can be ordered as a one-off purchase or an annual subscription.

A detailed presentation is available upon request.

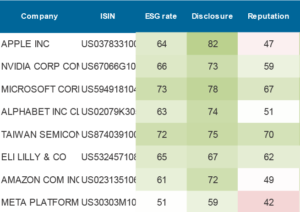

Covalence’s ESG ratings are aggregated to produce bespoke 3 to 4 pages portfolio reports that are produced on demand.

Covalence’s ESG ratings are aggregated to produce bespoke 3 to 4 pages portfolio reports that are produced on demand.

Our ESG ratings combine a measure of reputation, translating the perception of stakeholders such as the media and NGOs, both positive (endorsements) and negative (controversies), and a disclosure score, based on ESG indicators reported by companies and sourced from an external provider as well as on corporate communications.

Portfolio reports include the following metrics: ESG, E, S, G, 11 underlying categories, disclosure, reputation, controversy, greenwashing risk indicator.

Use cases are: portfolio management, ESG audits, assessments of asset managers, responses to RFPs.

Since 2001 we have been monitoring ESG news on a daily basis, both positive news (illustrating companies’ sustainability credentials) and negative news (reflecting controversies and the issues they are facing).

Since 2001 we have been monitoring ESG news on a daily basis, both positive news (illustrating companies’ sustainability credentials) and negative news (reflecting controversies and the issues they are facing).

This service is useful for identifying ESG-related opportunities and for managing legal, economic and reputational risks. Our dynamic, granular, news-based data informs on ESG practices (GRI-inspired criteria), impact (SDGs, SFDR) and materiality (SASB), providing signals relevant to quant trading and equity factor investing.

The news feed is available on our interactive data visualization platform. Data feeds can also be delivered via FTP, email or API in various formats (.xlsx, csv, json). Finally, users can receive email alerts to be informed of breaking news and recent developments.

![]() Covalence’s ESG rating system has been enriched with a greenwashing risk indicator highlighting discrepancies between companies’ promises and action regarding sustainability. Like a sincerity detector, this new indicator gives a more realistic picture of their ESG credentials while enabling to assess the credibility of sustainability commitments, analyze ESG risks, identify credible ESG leaders and spot companies showing most progress.

Covalence’s ESG rating system has been enriched with a greenwashing risk indicator highlighting discrepancies between companies’ promises and action regarding sustainability. Like a sincerity detector, this new indicator gives a more realistic picture of their ESG credentials while enabling to assess the credibility of sustainability commitments, analyze ESG risks, identify credible ESG leaders and spot companies showing most progress.

The greenwashing risk indicator is obtained by comparing forward-looking and backward-looking news sentiment. Forward-looking news data covers companies’ sustainability commitments and aspirational statements, while backward-looking data reflects how stakeholders perceive their achievements and past actions.

Use cases: portfolio risk analysis and reporting, institutional reputation management, portfolio management, ESG integration, shareholder engagement.

In 2024 researchers from The Polytechnic Institute of Paris have written an academic paper using data provided by Covalence, Can Investors Curb Greenwashing?

Covalence filters its ESG data and recodes it with the Sustainable Development Goals to show companies’ exposure to the SDGs and document their positive impacts, providing insightful material for impact analysis and supporting thematic investment strategies.

Covalence filters its ESG data and recodes it with the Sustainable Development Goals to show companies’ exposure to the SDGs and document their positive impacts, providing insightful material for impact analysis and supporting thematic investment strategies.

The recoding of ESG data with the SDGs takes place in both dimensions of Covalence’s methodology, disclosure and reputation.

For instance, the European Union has used our SDG scores to produce the 2021 EU Industrial R&D Investment Scoreboard.

Similarly, the data can be filtered with many different topics, such as palm oil, AI, biodiversity, circular economy, ethnic diversity or modern slavery, to produce bespoke thematic scores.

Covalence’s managing partner Antoine Mach is a trainer in sustainable finance and ESG analysis in several contexts:

In-house training, seminars and workshops built to help banks and asset managers comply with Swiss Banking’s guidelines on ESG investing and sustainable mortgages, as well as to AMAS’s sustainable finance self-regulation. These training courses can be recognized as SAQ recertification measures.

In-house training, seminars and workshops built to help banks and asset managers comply with Swiss Banking’s guidelines on ESG investing and sustainable mortgages, as well as to AMAS’s sustainable finance self-regulation. These training courses can be recognized as SAQ recertification measures.- Programme manager of Certificat ISFB Finance Durable offered by ISFB, Institut supérieur de formation bancaire (short course)

- Co-manager of the CAS Sustainable Finance offered by Haute école de gestion de Genève (HEG), recipient of the prize for Best Pedagogical Innovation at the FIR-PRI Finance & Sustainability Awards 2019 (long course)

![]() Covalence SA, a specialist in ESG ratings and research, and Sussland & Co SA, a Geneva-based wealth manager, joined their forces to offer the ZKB Tracker Certificate Dynamic on Sustainable Swiss Small and Mid-Caps in partnership with Zürcher Kantonalbank.

Covalence SA, a specialist in ESG ratings and research, and Sussland & Co SA, a Geneva-based wealth manager, joined their forces to offer the ZKB Tracker Certificate Dynamic on Sustainable Swiss Small and Mid-Caps in partnership with Zürcher Kantonalbank.

The product has as objective to provide investors with a highly diversified portfolio of shares of Swiss small and mid-cap companies that have demonstrated through their acts their commitment to the ESG mindset as well as the ability to generate a positive impact on communities.

The investment universe includes companies with market capitalisation between CHF 500 million et 20 billion, and registering an above average ESG rating, which represents approx. 80 companies.