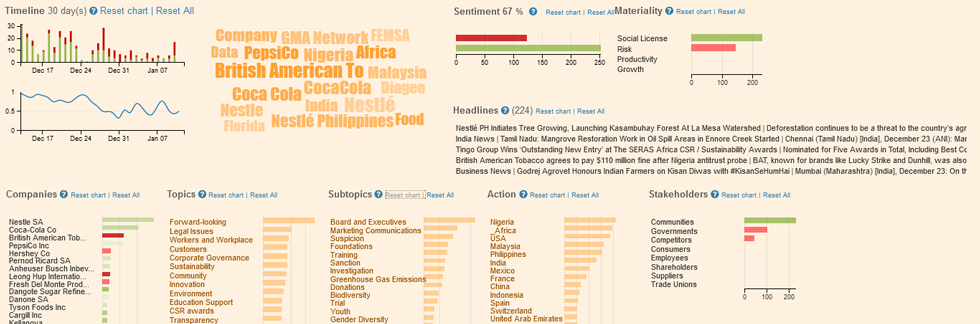

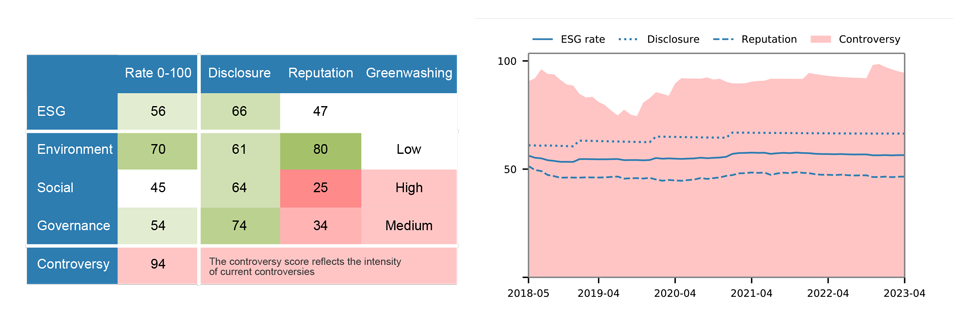

Founded in Geneva in 2001, Covalence produces environmental, social and governance (ESG) ratings by comparing corporate disclosures to news sentiment.

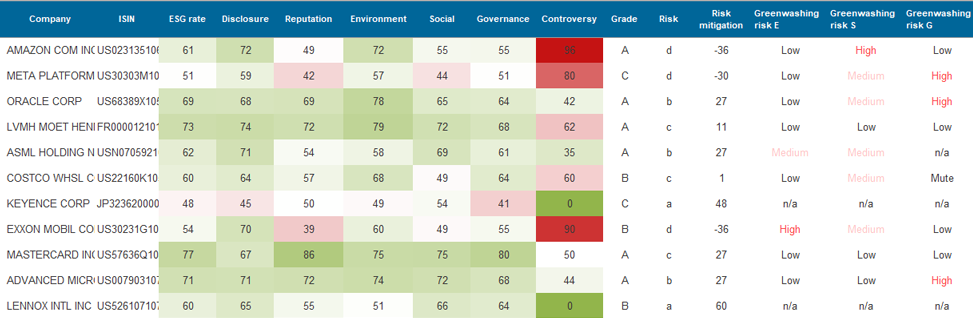

We offer ESG ratings and data covering 15,000 securities to investors, corporates, non-profits, and academics.

Covalence’s expertise is useful for investment management, ESG measurements, ESG news monitoring, reputation management, academic research, and training.

Our main differentiators are: ESG reputation tracking based on media monitoring, artificial intelligence and human analysis; dynamic, granular, news-based data informing about ESG practices (GRI-inspired criteria, UN Global Compact), impact (SDG, SFDR), and materiality (SASB); special skills on the S of ESG; forward-looking reputation score and greenwashing risk indicator.