Founded in Geneva in 2001, Covalence evaluates the environmental, social and governance (ESG) performance of thousands of companies around the world, with a focus on media analysis and social issues.

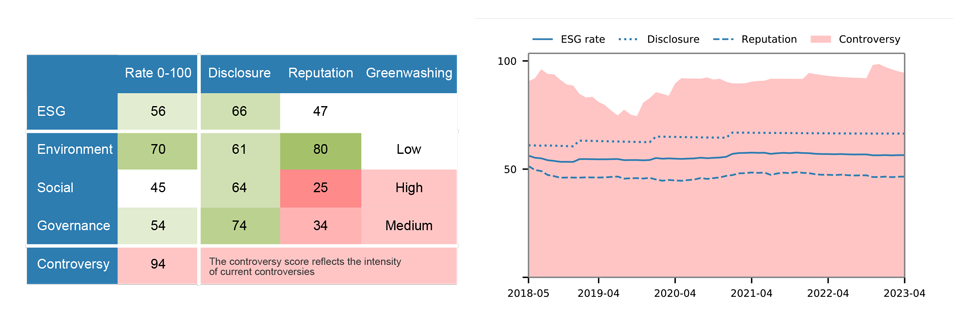

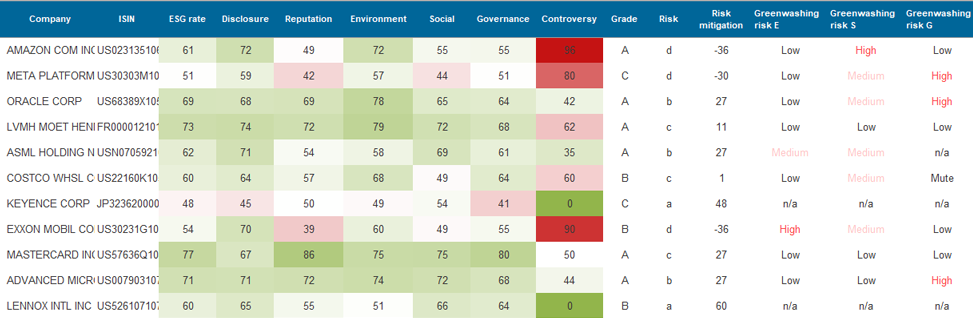

We provide professional investors with ESG ratings and data to monitor portfolios, define investment universes, track controversies, manage reputational risks and document positive impacts.

Covalence provides investors with ratings, news data, reports, and advisory supporting investment management, portfolio reporting and ESG assessments

Covalence provides data and advice to non-profit organizations working on, or with, multinational companies. These services are useful for: thematic studies and rankings, partner search, reputation risk management.

Covalence provides academics with ESG data and ratings supporting further research into the business case for sustainability

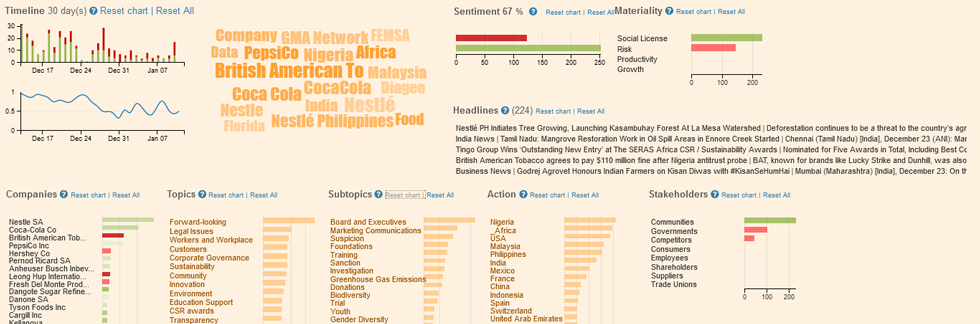

What’s on our ESG radar screen this week? Access current hot topics by clicking on our interactive charts. More…